It's ... planning season again!

How should you plan for annual sales planning?

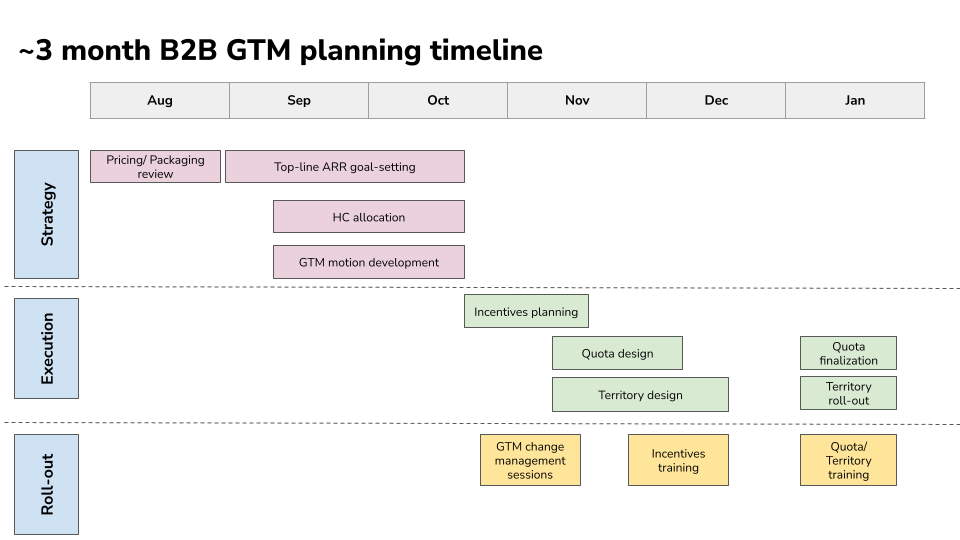

It comes back before you know it. Sales/GTM planning could take up to 12 weeks, from strategy and leadership buy-in all the way to roll out, change management and quota delivery. So, if you want to meet that gold standard of delivering a new and refreshed GTM strategy, incentive plans, quotas and territories just after your teams are back from the holidays in January, the process must start in September!

Planning may seem daunting at first, but breaking it down into the components below has helped me in all the planning seasons I have led over the years.

Let’s chat with finance! The top line ARR plan

Planning kicks off with a negotiation with finance. What should the top-line ARR goal for next year be? Finance teams are skilled at conducting top down assessments of revenue growth, but these assumptions always need to be validated bottoms-up by revenue operations.

For instance, if finance is planning on New ARR growing by 25% YoY due to an increase in deal volume, is that supported by sales performance? Will that come from increased sales headcount or from increased productivity per fully ramped sales rep? Are deal-size assumptions consistent with the sales motion? These are iterative conversations between finance and revenue operations.

Ultimately, the finance plan is a high-level number, at best broken down by New and Existing ARR, and by region. Revenue operations should stress test the ARR plan in partnership with finance, and evaluate the feasibility of the ARR drivers based on their understanding of expected sales performance (e.g. New business, upsell and cross-sell sales productivity, and Renewal rates by region, sales segment etc.)

What will it take? HC/ Resource allocation

Unless a major pricing/ packaging over-haul is underway, a large YoY increase in the ARR plan generally cannot be justified by an increase fully ramped sales productivity alone. It will also likely involve sales headcount growth.

Top-line ARR planning goes hand-in-hand with headcount planning. Where is it most profitable to add sales heads? LTV/CAC (Life time value/ Cost of acquisition), the Total Addressable Market and current market penetration can help make this decision. When should you stage the release of sales headcount? Time-to-hire and time-to-ramp should be considered so that the new sales headcount can start contributing to ARR goals in-year. Ensure that the additional sales headcount requested does not dilute territories and still maintains healthy LTV/CAC.

In addition to sales (AE) heads, BDR, CSM and other support resources should also be considered during resource allocation, based on pre-determined AE/BDR and AE/CSM ratios. More on that when we talk about the GTM motion!

(Of course, don’t forget to throw in your asks for revenue operations and enablement headcount! Revenue operations teams are often lean, but they do need investment to sustain growing GTM teams.)

How will you do it?

Annual planning is a great time to critically revisit how you take your product to the market. Ideally, you don’t want to change things around multiple times a year, or even every year, unless you have a strong signal that your current motion is not working.

The GTM motion

Where along the sales-led and product-led spectrum do you want to fall next year? Switching to a product-led sales motion from a traditional enterprise sales motion does not happen overnight. How much is your bottoms-up product adoption? Consider incorporating product signals into your sales process before committing to switch completely to a pure product-led motion.

How do you define your sales segments? Strategic, Enterprise, Mid-market and SMB definitions vary, but are often rooted in some measure of Size of Prize, most generally the number of employees in your target companies. You may draw tier-lines based on the maturity of your sales team and complexity of your sales motion.

Is there friction in your customer funnel? Unclear customer hand-off points? Which roles are responsible for land vs. expand? Does the AE land new deals, hand them over to the CSM and move on, or do they own up-sell and cross-sell as well? What is the role of the CSM? Who handles renewals? How many AEs can one CSM feasibly support? These may vary by segment!

BDRs will help your higher cost AEs in heavy outbound, more “traditional” enterprise sales motions which require a lot of qualification and prospecting. Product-led sales motions may not require quite as much BDR support. How many AEs can one BDR feasibly support? These could also vary by segment!

All these are questions you want to lock down as you finalize your annual plan and headcount resourcing.

The sales incentives

Once the top-line plan and GTM motion is set, how will you motivate and compensate your teams to hit these goals? Incentive planning involves walking the fine line of helping your sales teams “win” while also driving business outcomes.

Once roles and responsibilities are clearly delineated in the GTM motion, identify which critical business metrics each role is able to influence the most. Metrics proliferation in an incentive plan can result in lack of focus and also makes the plans more “game-able”. Pick not more than two metrics per role to include in incentive plans.

Output metrics are best suited to be added to incentive plans (think ARR for AEs, ARR Renewal rates for CSMs etc.) For roles like BDRs that are further removed from revenue, some activity/ effort metrics (e.g. leads qualified, pipeline generated etc.) may also be considered. Driver metrics *may* be added to plans if a large behavior change needs to be incentivized (e.g. pushing AEs to close New logos above a certain size), but the addition of these metrics could have unintended consequences, and take the focus off the primary output metrics, like ARR.

Pay mixes (base vs. variable) and pay curves will dictate the type of sales culture you want to nurture, so be intentional about those steep accelerators and downside penalties! Incentive planning is highly cross functional. Don’t forget to loop in finance and HR before getting leadership sign-off.

Sales quotas and territories

You are in the home stretch, but the most operationally intensive part of planning! Converting your top-line plan into rep level quotas is both an art and a science, incorporating industry standard expectations, historical performance, expected product and pricing changes, and available whitespace in territories.

In the interest of simplicity, you may want to consider setting uniform quotas within a region and segment (e.g. all Strategic AEs covering North America will carry the same ARR goal), however, to make this fair, territories will need to be balanced and uniform, especially if ARR from existing customers is also included. Generally, you “over-assign” quotas - the sum of your rep-level quotas would be higher than the annual plan to provide some buffer.

Don’t expect all your sales reps to hit quota. A bell curve distribution of quota attainment is a good outcome. In fact, more aggressive incentive plans count on some sales reps significantly over-achieving, some significantly under-achieving, while the bulk fall in the middle.

Territories and quotas go hand-in-hand. Assign fair and balanced territories that are rich enough to justify quotas, but also not so large that several accounts go untouched and over-looked. Some territory movement (especially early stage prospects) every year instills a healthy sense of competition, but too much movement (especially for existing customers and late stage prospects) creates disruption and lack of continuity. Product-led sales motions tend to incorporate some thresholds on bottoms-up product adoption as a determinant of territory quality (e.g. average Paid MAU per account in an Enterprise territory is xx).

The roll out plan

You need a plan for your planning season! Prepare a high-level timeline with the milestones you want to hit and all the cross-functional partners you want to bring on board. Socialize early and often with sales leadership. Work closely with sales enablement partners to plan the roll out with enablement sessions and change management, especially for large scale changes in GTM strategy, roles and responsibilities, incentive plans and quota structure.

You may need a week or two after year-end to evaluate the full year actual performance before finalizing rep level quotas, but socialize indicative quotas with sales leadership prior to year end, so they can prepare their teams.

Here is what a sample planning timeline might look like so you can hit the ground running in the new year!

This is great Aarti. Nicely written!